Table of Contents

Tip 1: Start Early

When it comes to investing, time is your best friend. The earlier you start, the more time your money has to grow through the power of compound interest. Compounding is the process where the interest you earn on your investment earns additional interest, creating a snowball effect that can significantly boost your wealth over time.

Imagine you invest $1,000 at an annual interest rate of 7%. After one year, you’d have $1,070. The next year, you earn interest not just on your initial $1,000, but also on the $70 interest from the first year. This cycle continues, and over a few decades, your initial investment can grow exponentially.

Starting early gives you the advantage of time, allowing you to ride out market fluctuations and take advantage of long-term growth trends. Even small, regular investments can add up to substantial wealth if you start early and remain consistent.

So, don’t wait for the “perfect” moment to start investing. The best time to start is now. Your future self will thank you for it!

Tip 2: Diversify Your Portfolio

“Diversification” might sound like a fancy financial term, but it’s a simple concept: don’t put all your eggs in one basket. Spreading your investments across various asset classes can reduce risk and increase potential returns.

Diversification helps protect your portfolio against market volatility. If one investment performs poorly, others may perform well, balancing out your overall returns. Here are a few ways to diversify:

- Stocks and Bonds: Stocks offer higher potential returns but come with higher risk. Bonds, on the other hand, are generally more stable but offer lower returns. Balancing these can create a more stable portfolio.

- Real Estate: Investing in real estate can provide a steady income stream and potential for appreciation. This can be through direct property ownership, Real Estate Investment Trusts (REITs), or real estate crowdfunding platforms.

- Mutual Funds and ETFs: These investment vehicles pool money from many investors to buy a diversified mix of assets. They offer an easy way to diversify without having to pick individual stocks or bonds.

- Commodities and Precious Metals: Investments in commodities like gold, silver, or oil can provide a hedge against inflation and add another layer of diversification.

- International Investments: Including international stocks and bonds can expose your portfolio to different economic cycles and growth opportunities outside your home country.

Diversifying doesn’t guarantee against loss, but it is a powerful tool to manage risk and smooth out returns over time. By spreading your investments, you can build a robust portfolio that’s better equipped to handle market ups and downs.

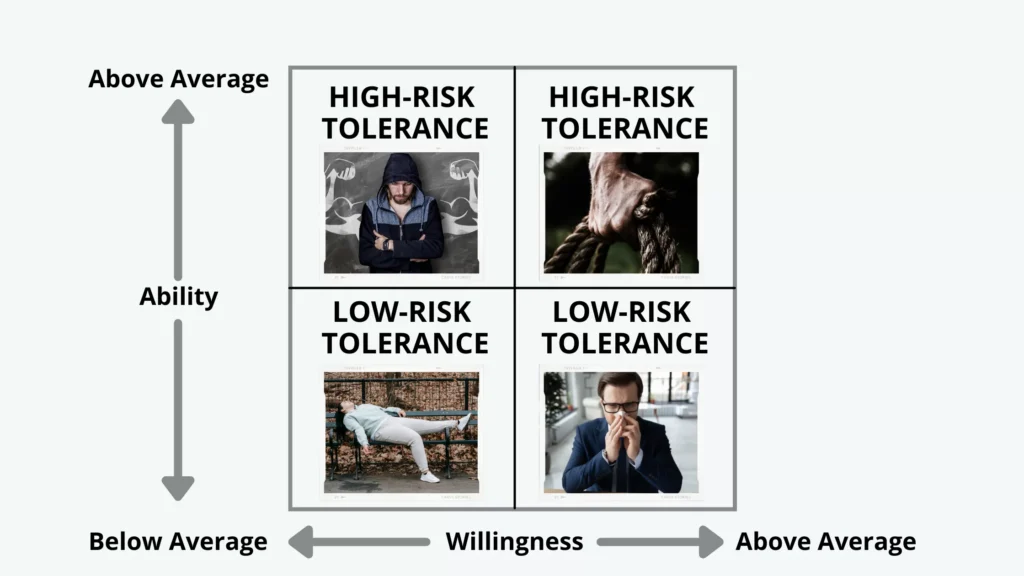

Tip 3: Understand Your Risk Tolerance

Investing always comes with some level of risk, but not all risks are created equal. Understanding your risk tolerance is crucial to making investment decisions that align with your comfort level and financial goals.

What is Risk Tolerance? Risk tolerance is your ability and willingness to endure market volatility and potential losses in your investment portfolio. It is influenced by various factors, including your investment goals, time horizon, financial situation, and personal comfort with uncertainty.

Assessing Your Risk Tolerance:

- Investment Goals: Are you investing for short-term gains, such as saving for a down payment on a house, or for long-term objectives, like retirement? Long-term goals typically allow for higher risk tolerance as you have more time to recover from market downturns.

- Time Horizon: The length of time you plan to hold an investment impacts your risk tolerance. If you have a longer time horizon, you can generally afford to take on more risk because you have time to ride out market fluctuations.

- Financial Situation: Consider your overall financial health, including income, savings, and expenses. If you have a stable income and a solid emergency fund, you may be more comfortable taking on higher risks.

- Emotional Comfort: How do you react to market volatility? If market dips cause you significant stress and anxiety, you may have a lower risk tolerance. It’s important to invest in a way that allows you to sleep well at night.

Tailoring Your Investments to Your Risk Tolerance:

- Conservative: If you have a low risk tolerance, focus on safer investments like bonds, blue-chip stocks, or dividend-paying stocks. These tend to be more stable and provide steady returns.

- Moderate: For a balanced approach, consider a mix of stocks and bonds, along with some real estate or mutual funds. This allows for growth potential while managing risk.

- Aggressive: If you can handle higher risk, you might invest more heavily in stocks, especially growth stocks or emerging markets, which offer higher potential returns but also higher volatility.

Knowing your risk tolerance helps you create an investment strategy that you can stick with, even during market turbulence. This consistency is key to achieving long-term financial success.

Tip 4: Educate Yourself Continuously

Investing is not a one-time activity; it’s a continuous journey of learning and adapting. The financial markets are dynamic, with new investment opportunities, strategies, and tools emerging regularly. Staying informed and educated is crucial to making wise investment decisions.

Why Continuous Education is Important:

- Market Trends: Understanding current market trends can help you make timely investment decisions and capitalize on new opportunities.

- Investment Strategies: There are countless strategies for investing, from value investing to growth investing, and new ones are developed all the time. Learning about different approaches can help you find the best fit for your goals.

- Economic Indicators: Economic factors like interest rates, inflation, and employment rates impact the markets. Being aware of these indicators can help you anticipate market movements.

- Regulatory Changes: Governments often update regulations that can affect your investments. Staying informed about these changes ensures you remain compliant and can adjust your strategies accordingly.

Ways to Educate Yourself:

- Books and eBooks: There are many excellent books on investing. Classics like “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton G. Malkiel provide timeless wisdom. For more recent insights, try “Rich Dad Poor Dad” by Robert Kiyosaki or “The Little Book of Common Sense Investing” by John C. Bogle.

- Online Courses and Webinars: Websites like Coursera, Udemy, and Khan Academy offer courses on investing and finance. Webinars from financial institutions and investment firms can also provide valuable information.

- Financial News and Blogs: Staying updated with financial news from sources like Bloomberg, CNBC, and Reuters can keep you informed about market developments. Blogs like Investopedia and Seeking Alpha offer in-depth analysis and advice.

- Podcasts and YouTube Channels: There are many podcasts and YouTube channels dedicated to investing. Shows like “The Motley Fool” podcast or channels like “Graham Stephan” on YouTube provide regular insights and tips.

- Investment Clubs and Online Communities: Joining investment clubs or online forums like Reddit’s r/investing can provide opportunities to discuss strategies and get advice from fellow investors.

Key Takeaway: The more you learn, the better equipped you are to make informed decisions and adapt to changing market conditions. Make continuous education a part of your investment routine to enhance your skills and stay ahead of the curve.

Tip 5: Set Clear Financial Goals

Setting clear financial goals is a crucial step in creating an effective investment strategy. Clear goals give you direction, help you measure progress, and keep you motivated.

Why Set Financial Goals?

- Direction and Focus: Clear goals provide a roadmap for your investment journey. They help you focus on what’s important and avoid distractions.

- Motivation: Having specific objectives can keep you motivated, especially during market downturns. When you have a clear vision of what you’re working towards, it’s easier to stay committed.

- Measuring Progress: Goals allow you to track your progress and make adjustments as needed. This ensures you’re on the right path and helps you celebrate milestones along the way.

How to Set Financial Goals:

- Be Specific: Vague goals like “get rich” or “save money” aren’t helpful. Instead, set specific goals like “save $50,000 for a down payment on a house in five years” or “generate $1,000 in monthly passive income within two years.”

- Make Them Measurable: Quantifiable goals allow you to track your progress. Use numbers and timelines to measure your success.

- Ensure They Are Achievable: While it’s great to aim high, your goals should be realistic and attainable. Setting unattainable goals can lead to frustration and discouragement.

- Keep Them Relevant: Your financial goals should align with your personal values and long-term aspirations. This ensures that your investment strategy supports your overall life plan.

- Set a Time Frame: Every goal should have a deadline. Whether it’s short-term (within a year), medium-term (1-5 years), or long-term (5+ years), having a time frame helps you stay focused and motivated.

Examples of Financial Goals:

- Short-Term: Save $5,000 for an emergency fund in one year.

- Medium-Term: Pay off $20,000 in student loans within three years.

- Long-Term: Build a retirement fund of $1 million by age 65.

Tracking and Adjusting Your Goals: Regularly review your goals and track your progress. Life circumstances and market conditions change, so be prepared to adjust your goals as needed. Use tools like budgeting apps, financial planners, or simple spreadsheets to keep track of your investments and ensure you’re on the right path.

Key Takeaway: Clear financial goals act as a compass for your investment journey. They help you stay focused, motivated, and on track to achieving your financial aspirations. Take the time to set, review, and adjust your goals to ensure your investments are aligned with your long-term plans.

Tip 7: Keep an Emergency Fund

An emergency fund is a crucial component of a solid financial plan. It provides a financial safety net to cover unexpected expenses or financial emergencies without derailing your investment strategy.

Why You Need an Emergency Fund:

- Peace of Mind: Knowing you have a cushion for emergencies reduces financial stress and allows you to focus on your long-term investment goals.

- Avoid Debt: An emergency fund helps you avoid high-interest debt from credit cards or personal loans when unexpected expenses arise.

- Protect Investments: Having readily accessible funds means you won’t have to sell your investments during a market downturn to cover unexpected costs.

How Much to Save: The general rule of thumb is to save three to six months’ worth of living expenses. This amount can vary based on your personal circumstances, such as job stability, income, and dependents. For example:

- Single with Stable Job: Aim for three months of expenses.

- Married with Dual Incomes: Three to six months may be sufficient, depending on job stability.

- Self-Employed or Irregular Income: Six to twelve months’ worth of expenses to account for income variability.

Building Your Emergency Fund:

- Set a Target Amount: Calculate your monthly living expenses, including rent/mortgage, utilities, groceries, transportation, insurance, and other essentials. Multiply this amount by the number of months you want to cover.

- Start Small and Be Consistent: Begin by setting aside a small portion of each paycheck. Automate your savings to ensure consistency and gradually increase the amount as you become more comfortable.

- Cut Unnecessary Expenses: Review your budget to identify areas where you can reduce spending. Redirect these savings into your emergency fund.

- Use Windfalls Wisely: Allocate any unexpected income, such as bonuses, tax refunds, or gifts, towards your emergency fund to accelerate your savings.

Where to Keep Your Emergency Fund:

- Savings Account: A high-yield savings account provides easy access to your funds and earns interest.

- Money Market Account: These accounts offer slightly higher interest rates than traditional savings accounts while still providing liquidity.

- Short-Term Certificates of Deposit (CDs): CDs can offer higher interest rates but require you to lock in your money for a set period. Use them only if you already have a portion of your emergency fund in more liquid accounts.

Key Takeaway: An emergency fund is essential for financial stability and peace of mind. By saving three to six months’ worth of living expenses and keeping the funds in a readily accessible account, you can protect yourself from financial emergencies and stay on track with your long-term investment goals.

Tip 8: Regularly Review and Rebalance Your Portfolio

Investing is not a “set it and forget it” activity. Regularly reviewing and rebalancing your portfolio is crucial to ensure it remains aligned with your financial goals, risk tolerance, and market conditions.

Why Regular Reviews and Rebalancing Are Important:

- Maintain Desired Asset Allocation: Over time, different investments will perform differently, causing your portfolio’s asset allocation to drift. Rebalancing helps bring it back to your desired mix.

- Manage Risk: Rebalancing ensures that your portfolio does not become too heavily weighted in a single asset class, which can increase risk.

- Capitalize on Market Opportunities: Regular reviews allow you to adjust your strategy based on market trends, economic conditions, and changes in your personal circumstances.

How to Review and Rebalance Your Portfolio:

- Set a Regular Review Schedule: Decide how often you will review your portfolio. Quarterly or semi-annual reviews are common, but you may choose to do it more or less frequently based on your needs and market conditions.

- Assess Current Asset Allocation: Compare your current asset allocation with your target allocation. Determine if any adjustments are needed to bring your portfolio back in line with your goals.

- Evaluate Individual Investments: Review the performance of each investment in your portfolio. Consider selling underperforming assets or those that no longer align with your investment strategy.

- Rebalance Through New Contributions: One of the easiest ways to rebalance is by directing new investments towards underweighted asset classes. This method avoids the need to sell existing investments, which can trigger capital gains taxes.

- Sell and Reinvest: If your portfolio has significantly drifted from your target allocation, you may need to sell some of your overperforming assets and reinvest the proceeds into underperforming ones. Be mindful of transaction costs and taxes when doing this.

- Consider Automated Rebalancing: Some investment platforms and robo-advisors offer automated rebalancing features. These tools can help maintain your desired asset allocation with minimal effort on your part.

Example of Rebalancing: Let’s say your target allocation is 60% stocks and 40% bonds. After a year of strong stock market performance, your portfolio has shifted to 70% stocks and 30% bonds. To rebalance, you would sell some of your stocks and buy more bonds to bring your allocation back to 60/40.

Key Takeaway: Regularly reviewing and rebalancing your portfolio is essential for maintaining your desired asset allocation and managing risk. By setting a regular review schedule and using strategies like directing new contributions or selling and reinvesting, you can ensure your investments remain aligned with your financial goals.

Tip 9: Take Advantage of Tax-Advantaged Accounts

Utilizing tax-advantaged accounts can significantly enhance your investment returns by reducing the amount of taxes you pay. Common types of these accounts include:

- Individual Retirement Accounts (IRAs): Traditional IRAs offer tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement.

- 401(k) Plans: Employer-sponsored plans that often include matching contributions. Contributions are made pre-tax, reducing your taxable income.

- Health Savings Accounts (HSAs): Triple tax-advantaged accounts where contributions, growth, and withdrawals (for qualified medical expenses) are all tax-free.

Key Takeaway: Maximize contributions to tax-advantaged accounts to reduce your taxable income and boost your long-term savings.

Tip 10: Seek Professional Advice When Needed

Even the most seasoned investors can benefit from professional advice. Financial advisors can provide personalized guidance, help you develop a comprehensive plan, and offer strategies you might not have considered.

Key Takeaway: Consult a financial advisor to optimize your investment strategy and make informed decisions, especially when dealing with complex financial situations.

Want some free games?